Western Union: A Comprehensive Guide

Western Union is a well-known financial services company that has been transferring money for almost 150 years. The corporation has a global presence in over 200 countries and territories and is a well-known name in the financial services market. We will explore the main benefits and operations of Western Union, the various ways to send and receive money using Western Union, and why individuals should use Western Union for their money transfer needs in this complete guide.

Whether you use Western Union’s services frequently or for the first time, this comprehensive guide will provide you with all the information you need to know about this reputable financial services provider.

Western Union’s Core Benefits or Functions

The corporation is based in Denver, Colorado and is a well-known financial services company that offers a wide range of services to its consumers. In this section, we will go through Western Union’s main perks and functions

Services for Money Transfer

Western Union’s main business is money transfer services. Customers can send and receive money from practically anywhere in the world using the company. Western Union offers numerous ways to transfer and receive money, including online, in-person, and via the Western Union mobile app. Western Union’s money transfer services are quick, safe, and easy.

Services for Foreign Exchange

Customers can swap one currency for another using Western Union’s foreign exchange services. Customers can convert currencies with Western Union online, in person, or via the Western Union mobile app at affordable exchange rates.

Prepaid Cards

Western Union also provides prepaid cards that can be used in the same way as a credit or debit card. People who do not have a bank account or do not wish to utilize their bank account for particular transactions frequently use these cards. Prepaid cards from Western Union can be loaded with money at Western Union facilities, and cash can be withdrawn at ATMs or spent on purchases.

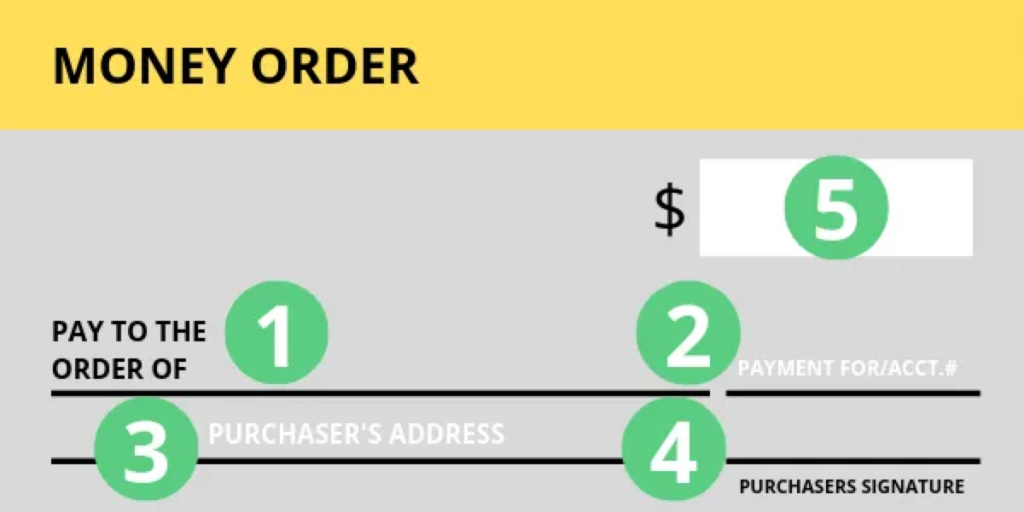

Orders for Money

Money orders, which are a safe form of payment that can be used in place of cash, are also available from Western Union. Money orders are frequently used to pay companies or persons who do not accept personal cheques or credit cards. Money orders from Western Union are commonly accepted and can be used to pay bills or purchase products and services.

Payment of Bills

Customers can pay their invoices using Western Union either online or in person at a Western Union facility. Customers can use Western Union’s bill payment services to pay their utility bills, rent, and other payments. This service is offered in the United States, Canada, and others.

Ways to Send and Receive Money

Western Union offers a variety of methods for transferring and receiving money. This section will go over the many methods for sending and receiving money using Western Union.

Online

Western Union’s online service.

- Customers can use Western Union’s online service to send and receive money.

- in order to send money online. customers must first open a Western Union account.

- Customers can use a credit card or bank account to send money to practically any country in the world once their account is set up.

Mobile Apps

Western Union’s mobile app.

- Customers can use their smartphones to send and receive money via Western Union’s mobile app.

- Customers must first download the Western Union app and create an account before they can utilize the mobile app.

- Customers can use their smartphones to send and receive money from practically anywhere in the world once their account is set up.

In-Person

Western Union agent location.

- Customers can send and receive money in person at over 500,000 Western Union agent locations globally.

- Customers who want to send money in person must go to a Western Union agent location.

- When the transaction is complete, the recipient can pick up the funds at another Western Union location by entering a identification number.

Why Use Western Union Around the World?

Western Union is a well-known financial services company that offers a variety of services to its consumers. In this part, we’ll go over why customers should use Western Union for money transfers.

Quick and convenient

Western Union’s services are available 24 hours a day, seven days a week, allowing consumers to send and receive money online, in-person, or via the smartphone app at any time, making it simple to transfer money from virtually anywhere in the world.

Secure

Western Union has put in place a number of safeguards to secure the security of its customers’ transactions. Western Union protects its clients’ personal and financial information with strong encryption technologies. A fraud detection system is also in place at the organization to detect and prevent fraudulent transactions.

Competitive Exchange Rates

Customers can transfer money at an affordable rate thanks to Western Union’s favorable exchange rates. The organization continually adjusts its exchange rates to ensure that consumers obtain the most up-to-date rates.

Variety of Services

Western Union provides a variety of services such as money transfers, bill payments, money orders, prepaid cards, and foreign exchange. Customers can then select the service that best meets their needs.

Global Reach

With over 500,000 agent locations in over 200 nations and territories, Western Union has a global reach. Customers can now send and receive money from practically anywhere in the world.

Customer Service

Western Union provides a specialized customer support service that is accessible 24 hours a day, seven days a week to assist customers with any inquiries or issues. Customers can get in touch with Western Union via phone, email, or live chat.

Background of Western Union

Western Union has a long history extending back to the mid-nineteenth century. Ezra Cornell, the founder of Cornell University, established it in 1851 as the New York and Mississippi Valley Printing Telegraph Company. Initially, the company’s major operation was to send telegrams across the country. The corporation expanded quickly and built a nationwide network of telegraph lines.

The corporation changed its name to Western Union Telegraph corporation in 1861 and expanded its business to include money transmission. The “Gold Rush” service, which allowed users to send and receive money between New York and California, was the company’s initial money transfer business.

Western Union continued to extend its money transfer services in the years that followed, introducing various improvements that made it easier and more convenient for clients to send and receive money. Western Union invented the money order in 1871 as a safe form of payment that could be used in place of cash. Money orders grew in popularity, particularly among immigrants who sought to send money back to their families in their native countries.

Western Union pioneered the telex transfer in 1933, allowing consumers to send money rapidly and securely using the telegraph system. Telex transfers were notably popular among corporations and governments that wanted to shift money swiftly and efficiently across borders.

Western Union has continued to innovate and expand its offerings over the years. The corporation launched electronic funds transfer (EFT) services in the 1980s, allowing consumers to transfer payments electronically across bank accounts. Western Union established online money transfer services in the 1990s, allowing users to send and receive money from the convenience of their own homes.

Western Union spun off its financial services segment into a new firm called First Data Corporation in 2006. However, Western Union repurchased the financial services division in 2009 and refocused on money transfer services.

Every year, millions of customers use the company’s services to transfer and receive money swiftly, securely, and easily. Western Union continues to innovate and expand its services, offering clients new and inventive methods to transfer and receive money.